Here in this article, you can download different formats of Payment Voucher in Word, Excel & PDF. In GST (Goods and Services Tax) different transactions involve issuance of different vouchers/invoices. The type of invoice to be issued depends upon the category of supplies and goods and services supplied. Among that GST Payment Voucher is a newly introduced one. Payment Voucher in GST under Reverse Charge Mechanism in GST is a proof of transaction between Taxpayer and unregistered supplier. Preparation of Payment voucher is a mandatory action under Reverse Charge Mechanism (RCM).

What is the Payment Voucher?

What is the Payment Voucher?

As per Central Goods and Services Act, the recipient of goods who is registered under GST Act has to issue Payment Voucher on transactions for supply of goods and services under Reverse Charge Mechanism. The registered person under GST is liable to pay tax under RCM in the following cases.

- The registered person makes supply of goods and services on which RCM is applicable.

- If the recipient of goods and services receives the supplies from an unregistered person.

In the above cases, the registered person is liable to make the payment must issue an invoice for the goods and services received by him. Such a registered person receiving the supplies should also issue a Payment Voucher to the unregistered supplier at the time of making the payment. The Supplier cannot issue Tax Invoice so he needs to issue a Payment Voucher.

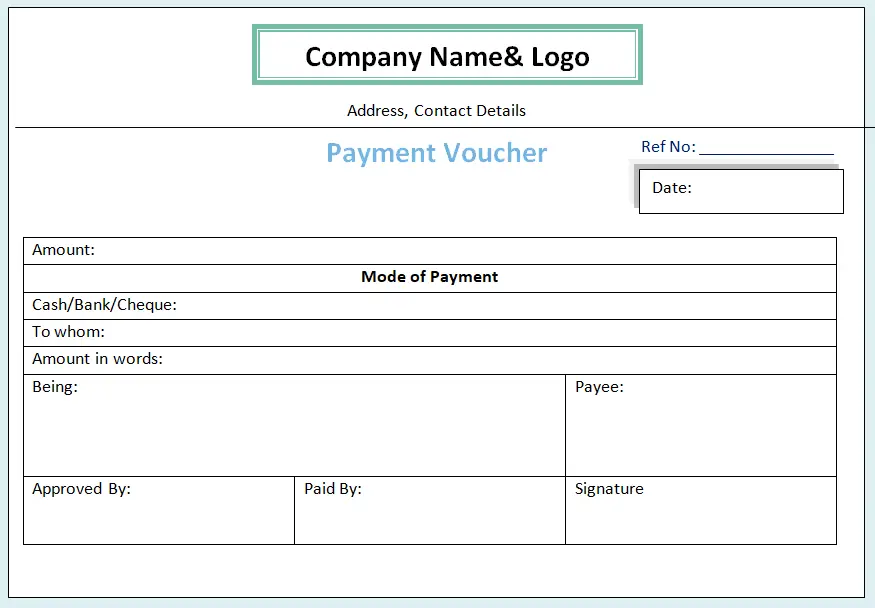

Download Payment Vouchers Sample Format

The following are formats of Payment Vouchers in word, Excel & PDF. We know there are different types of payment voucher cash payment vouchers, bank payment vouchers as well as cheque payment voucher formats.

| Formats | Links |

| Word Payment Voucher- Format 1 | Download |

| Payment Voucher Template – Format 2 | Download |

| Payment Voucher – Format 3 | Download |

| PDF Format – 4 | Download |

Advance Payment Voucher Format

Checklist for Payment Voucher in GST

The following particulars have to be mentioned in Payment Vouchers in GST:

- Name, Address and GSTIN of the of the supplier (if registered)

- Unique serial number of the financial year (not exceeding 16 characters )

- Date of issue payment voucher

- Name, Address and GSTIN of the recipient

- Description of goods and services (on which tax is paid on Reverse Charge mechanism)

- Amount paid to the Supplier

- The rate of GST and the amount of tax charged under CGST, SGST and IGST or cess

- Place of Supply, if the transaction is made in interstate mention the state name and state code.

- Signature/Digital Signature of the supplier or the Authorized representative of the supplier.

Payment Voucher Entry in TALLY

The following are the step by step procedure for making payment voucher entry in tally.

- From “GATEWAY OF TALLY“, go to “Accounting Vouchers“

- Press F5 (or) select Payment voucher from the right of the page

- Now press ALT+S (or) STAT Payment for Statutory Payment option

- Select GST from the type of Duty/Tax. This is used to define a GST payment in Tally so that it will reflect in GST return as well.

- Then select the period for which you are going to make payment i.e., either monthly or quarterly.

- Payment type should be “Regular”.

- On the Debit side enter the appropriate GST ledger for which tax liability is pending and on the credit side select the bank account from which you are going to make the payment. Also enter the Bank details like Mode of payment, Bank name, Payment date etc.

Journal Entry

| Particulars | Debit | Credit |

| CGST/SGST/IGST A/c Dr To Bank A/c (Being the amount of GST Paid) |

0000 |

0000 |

The recipient of goods and services needs to generate Payment Voucher while making the payment on which RCM is applicable. As mentioned above you can download the Payment Voucher in GST and make the above entry in the Tally to book the payment made.