TDS Challan Status: How to view TDS Challan receipt on NSDL using BIN or CIN? You can check filed TDS statement on income tax department website, from there a tax deductor can download TDS Challan. “Tax Deduction at Source” (TDS) is a form of indirect tax managed by the “Central Board of Indirect Taxes” (CBIT). In TDS, the person responsible to make payments like Salary, Rent, Interest, Commission etc., is liable to deduct TDS from the gross amount payable and deposit the same to the Income Tax Department within the specified due dates.

How to Check TDS Challan Status

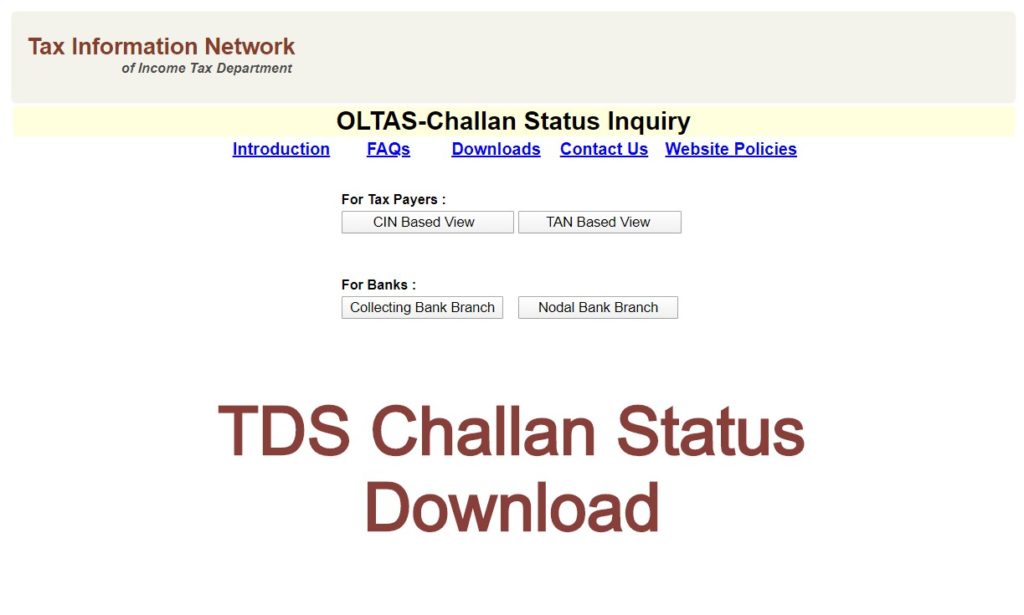

Step 1: Open the TIN-NSDL website or Link https://tin.tin.nsdl.cpm/oltas/index.html

Step 2: Select either CIN view or TAN view

Step 3: Fill up the required details.

- For CIN based view the following details to be entered:

- BSR Code

- Challan tender date

- For TAN based view the following details to be entered:

- TAN

- Challan tender date (date on which challan is paid)

Step 4: The deductor may also download the challan file for the selected period through TAN based view.

The person liable to deduct TDS is liable to pay a penalty of Rs.10,000 if he fails to quote his TAN number on all communication about TDS to Income Tax Department.

Types of Challan

There are 2 types of TDS challans.

- TDS Challan 281

The person responsible to pay TDS can file TDS challan 281 both online as well as offline (through banks). This challan is used by companies as well as non-corporate entities.

CIN (Challan Identification Number) is issued when the payment is made online or through banks.

- TDS Challan 280

For payment of Advance Tax, Self Assessment Tax, Corporation and other taxes TDS Challan 280 is used Challan No./ITNS 280 is required for payment of Income & Corporation Taxes irrespective whether file online or offline. Therefore it should be paid by depositor.

TDS Online Payment

How to Deposit the Deducted TDS?

- As mentioned the deducted TDS has to be deposited to government by 7th of the next month in which TDS is deducted and by 30th April for the month of March.

- A Statement showing TDS Collected & Deposited has to be submitted on a quarterly basis after which a TDS Certificate is issued to the payee.

- The person responsible for deducting TDS should get TAN (Tax Deduction and Collection Account Number).

- A “TDS Challan” shall be used for depositing TDS to the government.

- A single challan shall be used for tax collected under various sections.

- If a person wishes to pay without using the challan the TDS should be deposited on the same day