TDS full form “Tax Deduction at Source” is a system of collecting Income Tax by the government is deducted at the time of making some payments like salary, rent, sale of property, interest, commission etc. In this post, we discuss How to Pay TDS Online. I hope we covered complete details about the Online TDS Challan Payment, TDS Online Payment and TDS Challan Status check. Step by step guide ton How to create TDS Challan? and How to Download TDS Challan?

How to Pay TDS Online Payment?

TDS deducted at source by the taxpayer for paying the income tax under the provisions of Income Tax Act, 1961. The TDS amount based on prescribed TDS Rates and at the time of payment of certain specified income to the payee. The TDS collected amount must be paid to the government within the due dates. You can make TDS payment online, follow below step by step guide.

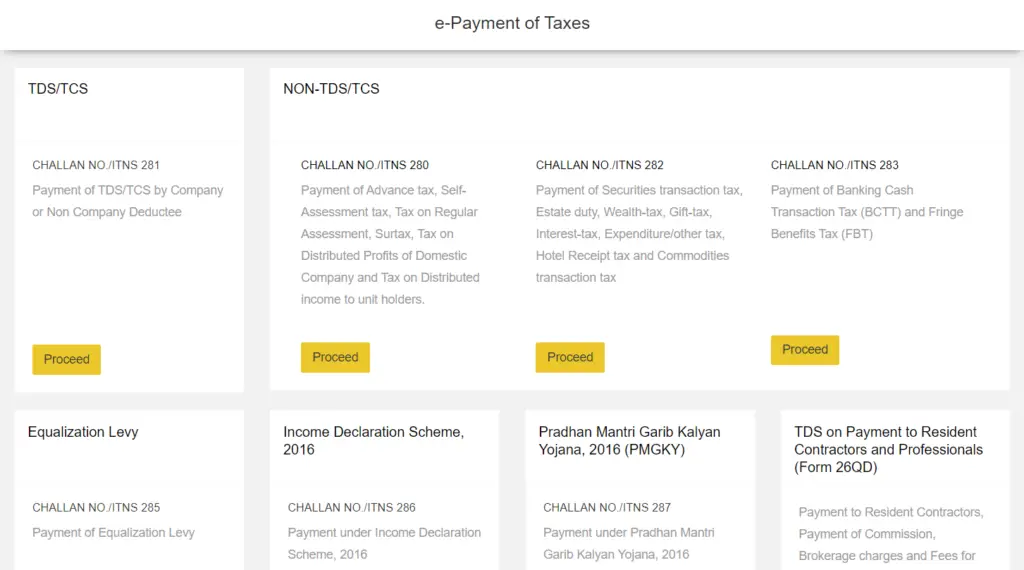

Step-1: To pay TDS online, logon to “e-Payment for TDS/TIN”.

Step-2: Here you can find different challans used for making various TDS Payments. Then, select the relevant challan to your TDS Payment (ITNS 280, ITNS 281, ITNS 282, ITNS 283, ITNS 284 or Form 26 QB. Select Challan NO./ ITNS 281. This challan is used for payment of TDS/TCS by company or non-company deductee.

Step 3: Fill the following details

- If Deductee is a Company: Select (0020) B) If Deductee is a person: Select (0021)

- Select the type of payment. If TDS/TCS is payable by the taxpayer by himself select (200) TDS/TCS Payable by Taxpayer. However, if TDS is payable via regular assessment as an outcome of a demand raised by the income tax department choose ‘(400) TDS/TCS Regular Assessment’.

- Choose the mode of payment (Net-Banking/Debit Card) on which TDS is Payable.

- Enter your (TAX DEDUCTION ACCOUNT NUMBER) TAN details. In case the TAN Number is not available within the database of the income tax authorities, the taxpayer would not continue the further steps.

- Enter the applicable Assessment Year.

- Enter other basic details like address, email id, mobile number etc.

- Enter the given captcha code and click on “Proceed”

Step 4: Once you go through all the information thoroughly, you need to confirm all the details entered in the challan were correct.

Step 5: On successful TDS online payment of challan counterfoil will be displayed on your display containing CIN, payment amount details and bank name through which e-payment has been used.

This counterfoil is proof of payment being made.

Steps to Check TDS Challan Status

Also, read how you can check TDS Challan Status online? Using status inquiry facility Taxpayers can know that their tax payment has been properly accounted for in your name. There are 2 ways we can track TDS challan Status:

After successful TDS Payment online, you need to track challan status in the ‘Challan Status Inquiry” on the NSDL portal. You can do this after 7 days of payment. (NSDL Potal>Services>Challan Status Inquiry)

There are two ways: 1. CIN based view, 2. TAN based view

1) CIN based view:

On entering Challan Identification Number (CIN i.e. details such as BSR Code of Collecting Branch, Challan Tender Date & Challan Serial No.) and amount (optional), the taxpayer can view the following details:

- BSR Code

- Date of Deposit

- Challan Serial Number

- Major Head Code with description

- TAN/PAN

- Name of Tax Payer

- Received by TIN on (i.e. date of receipt by TIN)

- Confirmation that the amount entered is correct (if amount is entered)

2) TAN based view:

By providing TAN and Challan Tender Date range for a particular financial year, the taxpayer can view the following details:

- CIN

- Major Head Code with description

- Minor Head Code

- Nature of Payment

If the taxpayer enters the amount against a CIN, the system will confirm whether it matches the details of the amount uploaded by the bank.