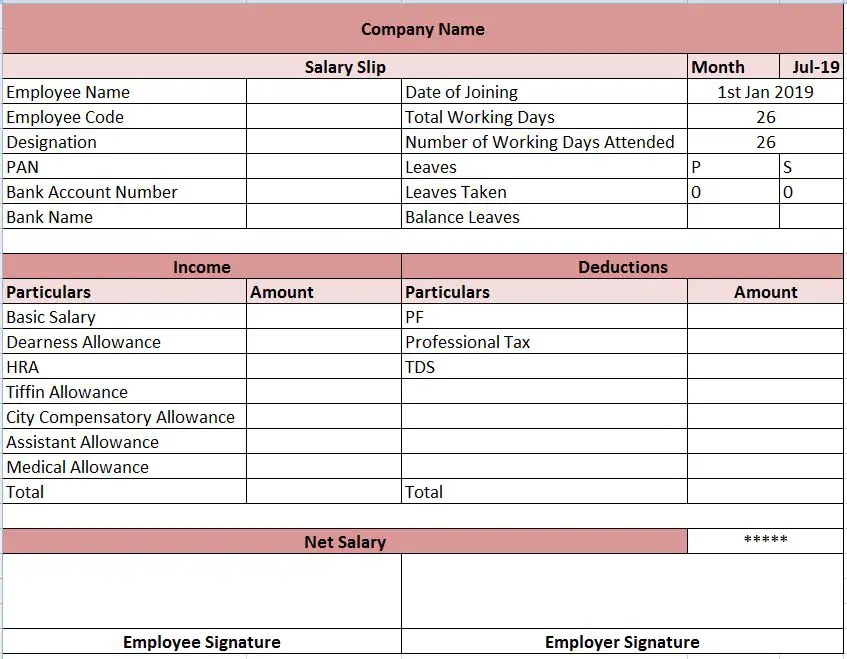

Salary Slip Format Excel: What is Salary Slip? How to prepare Salary Slip in Excel? “Salary Slip” also called as “Pay Slip“. A salary slip is a receipt prepared by the accountant instead of an employer to an employee at the end of every month. It contains a detailed description of the employee’s salary components like Company Name, Pay Slip Month, Name, Identification Number, Bank Account Number, Basic Salary, Gross Salary, Allowances, HRA, reimbursements, Provident Fund, TDS, Bonus paid etc and deductions for a specified time period, usually a month. It may be issued on paper or mailed to the employee. Employers are legally bound to issue salary slips to their employees periodically, as proof of salary payments to employees and deductions made. You can prepare salary slip in a few minutes with help these templates, simpler for HR professionals, HR executives, Administrative staffs etc.

Salary slip is a document issued by the employer to the employee every month upon receipt of a salary. Salary Pay Slip is an HR/Payroll document. Payslips are an important part of the Payroll process.

Download Different Formats of Payslips

| Formats | Link |

| Download Salary Slip Format in Excel | Download |

| Download Excel Salary Slip Format | Download |

| Download Salary Slip Format in Word | Download |

| Download Word Salary Slip Format | Download |

| Download Salary Slip PDF Format | Download |

| Download Salary Slip Format | Download |

| Download Pay Slip Format | Download |

The format of Payslip consists of all earnings (fixed and variable) and deductions (fixed and variable) along with the mandatory tax deductions like TDS and FBT.

Here we prepared few Salary Slip Excel Formats with predefined formulas. It can help to calculate the Gross earnings and deductions.

Important Salary Slip Excel Format

- Header: Company Name

- Employee Details

- Salary Components

- Summary

- Approval and Notes

Few Salary Slip Formulas

| Particulars | Formula |

| Taxable Income | Income(Gross Salary + Other Income) – Deductions |

| CTC= Total salary package of the employee | Gross Salary + PF + Gratuity |

| Gross Salary | Basic Salary + HRA + Other Allowances |

| Net Salary | Basic Salary + HRA + Allowances – Income Tax – Employer’s Provident Fund – Professional Tax |

Incomes

- Basic Salary

- Dearness Allowance

- House Rent Allowance (HRA)

- Conveyance Allowance

- Leave Travel Allowance

- Medical Allowance

- Performance Bonus and Special Allowance

- Other Allowances

Deduction

- HRA (House Rent Allowance

- PF (Provident Fund)

- Standard Deduction

- Professional Tax

- TDS (Tax Deductible at Source)

- Telephone bills reimbursement, Medical reimbursements etc. are exempt from the tax deduction

- Loans EMI

- ESI

- Health Insurance

Additionally, Payslip is very important for applying credit card, loans, mortgage of houses and the government benefits such as tax benefits, subsidy and medical benefits.

The employee Salary Slip is a very important legal document proof for his earnings. That’s why according to law, it is your right to ask for the Pay Slip if your company is not issuing it. While every company has to provide you Pay Slips, few companies even offer a print of payslip to their employee or email salary slip in PDF format to their employees so that we can download the payslip anytime.

Kindly advise how to change the company name as the sheet is protected kindly share password to unlock it